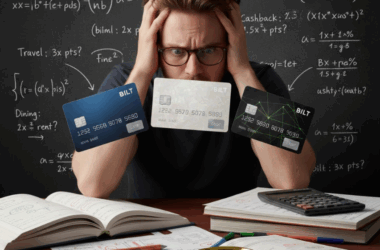

No topic in the world of miles and points has garnered more attention or gnashing of teeth in the past two weeks as the launch of Bilt 2.0. It’s been widely criticized as a very confusing launch with even founder Ankur Jain admitting “real and reasonable confusion about the new value proposition—especially around rent and mortgage points.” As more information continues to emerge, things haven’t gotten better.

Yes, we now know the first group of other uses for Bilt Cash besides unlocking earning points when paying rent or mortgages. We also know the details on the two different ways to earn points on that housing spend; Bilt Cash or card spend. But many, especially legacy Bilt 1.0 customers, are very upset about losing points earning on rent with only 5 card transactions in a month. Is their ire justified?

Sustainably rewarding customers?

Simply put, Bilt 1.0 was not sustainable. It has been reported that Wells Fargo was losing ten million dollars a month funding the rewards; it’s no surprise they backed out. Now that the Bilt cards will be issued by Cardless, they would have to be idiots to offer a similar points earning setup.

Think about it: it was possible to earn 2000, 3000, even 4000 points per month just by putting a few cheap transactions on the card. Now, imagine that expanded to a much bigger group of customers spending the same or higher amounts per month on their mortgage. That’s not a business model, it’s suicide.

In his email to customers, Jain continued “There’s also an important reality behind how we deliver the richest rewards possible. The more members use the card for everyday spend, the more unique value we can sustainably provide across the Bilt ecosystem. It is probably not a surprise to any of you, but if members only purchase four bananas and earn free rent points, it doesn’t allow us to sustain such a rich value proposition for everyone.“

Let me ask it this way: would you rather Bilt keep the same earning approach, have everyone take advantage of it, then go out of business in 6 months like the Mesa program did recently? I didn’t think so.

Unpopular opinion: Bilt 2.0 complexity will make it more sustainable

Given its unique set of transfer partners, it is easy to argue that Bilt points are the single most valuable transferrable points currency. I for one really want Bilt to stick around for the long term. That won’t happen if an even bigger group of customers extracts outsized value from the program. With that in mind, a part of me is actually excited that the new program is needlessly complex.

That’s right, excited. Why? The more complex it is, the fewer people will make the effort to optimize. There will be fewer points earned than could have been: is option 1 or option 2 better for earning, Bilt Cash will expire, and Bilt Cash will be used for suboptimal redemptions.

For those of us willing to put in the time and effort to optimize, the rewards will be richer. It’s the same advice I give to people unwilling to leverage the best transfer partners for travel. If that’s too complex or they want to transfer all their points to IHG, Marriott, or Southwest, I say “just get a 2% cash back card and move on”. I get it, this game is not for everyone.

However, if you are willing to learn the nuances of partner award charts, tools to hunt business class award space and how you can get lounge access, I believe you too should be a little big excited about the Bilt 2.0 complexity. Is it really that much worse?

In this hobby, deals come and go all the time. But one thing is universally true: the more lucrative the deal, and the easier it is to take advantage of, the faster it dies. That’s just the way it is.

2 keep-it-simple examples

I recently did a deep dive analysis on Bilt 2.0 points earning potential so I won’t rehash all of that here. But let’s consider two simple examples.

- Get the Obsidian card and spend $1200 per month at the grocery store. For most families of four, that is pretty common these days, or if needed, supplement with some Amazon gift cards or similar. If your housing payment was $2400 per month, you could earn 4.5 points per dollar (75% points by spending 50% of your housing cost) on that spend with option 1 or 4.33 points with option 2 (Bilt Cash).

- Get the Palladium card and spend 75% of your housing cost per month and get an effective 3.33 points per dollar on all spend. That’s powerful, and simple! The spend requirement would be even lower in the real world with the starting Bilt Cash you get each year. Or, use that extra Bilt Cash to buy the extra 1 point per dollar on your next $5k of spend.

Neither of these options is that complex, but both are highly valuable. If you aren’t willing to at least think through those examples, then maybe Bilt isn’t for you. That’s ok too. I don’t want any additional mental load to deal with, but as much as I hate that, I love Hyatt and Alaska points even more.

As the dust settles, how are you thinking about Bilt 2.0?

TL;DR: The shift from Bilt 1.0 to 2.0 has sparked major backlash due to its “needlessly complex” earning structure, but this friction might actually be its greatest strength.

The Bottom Line: If you want access to premium partners like Hyatt and Alaska, you have to embrace the math. The easiest deals die first; complexity keeps this one alive.

Sustainability is Key: The old model was a money-loser (reportedly costing Wells Fargo $10M/month). To survive, Bilt had to end the “four bananas for free rent points” era.

The “Complexity Dividend”: Higher complexity acts as a barrier to entry. While casual users may disengage or settle for suboptimal rewards, dedicated “optimizers” can still extract massive value.

Feel the same way. People are just used to pushing a couple of buttons and then flying business class which as a points and miles person of over 2 decades annoys me a little. Value is had in annoying programs like EVA where the average joe points person isn’t willing to fill out a few forms and wait a few days. There are even point tubers who pawn themselves off as experts with card consulting services that don’t understand why seats.aero doesn’t work with EVA. With Bilt 2.0 all they are asking is for you to put spend on the card but that’s somehow seen as offensive. Anyone can easily earn between 2x-4.33x catch all just depends on how much they want to optimize the Palladium card. People can make it as simple or as complex as they want it to be which is true freedom unlike the csr or platinum where you have to find a way to claw back your AF.

Spot on. Personally, I would highly prefer upfront/one-time complicated math to a coupon book. If the Palladium card was $199 with no hotel credit and no Priority Pass, I would have applied on day 1.