The launch and then quick pivot of the Bilt 2.0 program certainly drew the attention of the miles and points world last week, and not necessarily in the best of ways. It is widely acknowledged as more confusing and unfortunately, there are more questions than answers at this time. At the center of the confusion are the now two different paths to earn Bilt points on housing payments. Which option is best? Let’s see what the math says.

Note: I have no financial relationship with Bilt and this analysis represents the decision-making process for my specific situation. You can definitely tell those who do and have remained “generically positive” with all these changes. I do credit the team at Frequent Miler though – working through this with integrity and objectivity as Bilt is an advertiser on their podcast. Kudos to them and a “Hmmm” to some others.

Background

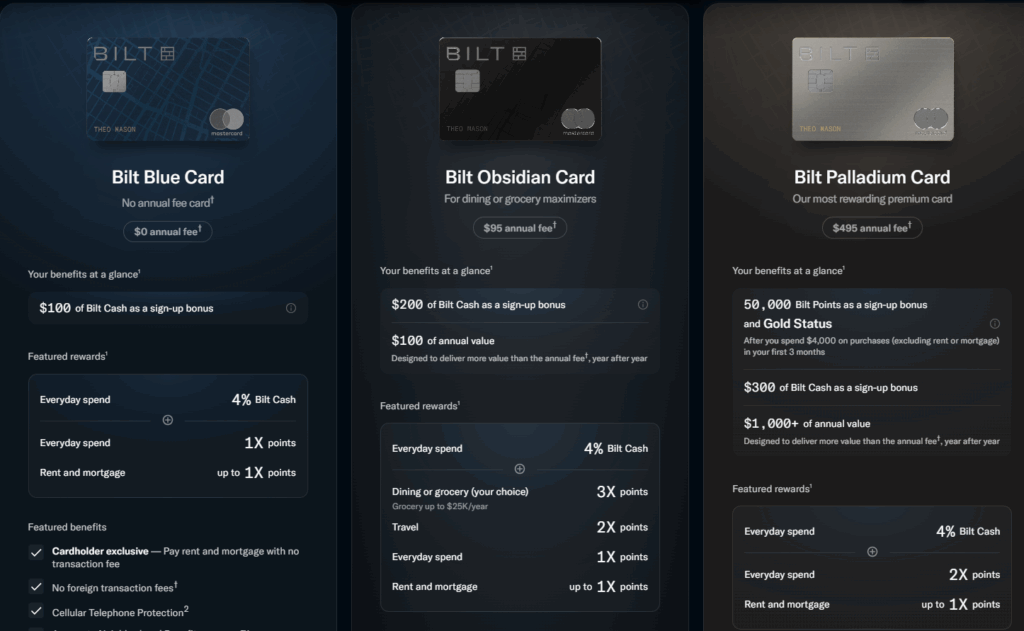

When Bilt 2.0 was launched last week, we learned the details of the 3 new credit cards. All earn 4% in Bilt Cash and while we don’t know all of the uses of Bilt Cash yet, we know that it can be used to offset the 3% fee for processing rent or mortgage payments, effectively unlocking earning Bilt point for that expense. Note that it is still possible to pay for rent or mortgage without any fees, you just won’t earn any Bilt points on that spend. Since the goal of miles and points is to maximize our points earning and redemption, I am going to focus on the path that allows points to be earning paying for housing.

Adding another of complexity is the starting Bilt Cash available with each card. You can earn $100, $200, or effectively $500 ($300 sign-up bonus and $200 annual benefit) in Bilt Cash respectively from these 3 cards for the first year. This reduces the amount you would have to spend in order to earn points on your housing costs. However, you can only carry over $100 max in Bilt Cash at the end of the year. And we still don’t know how else Bilt Cash can be used. Whew! Are you with me so far?

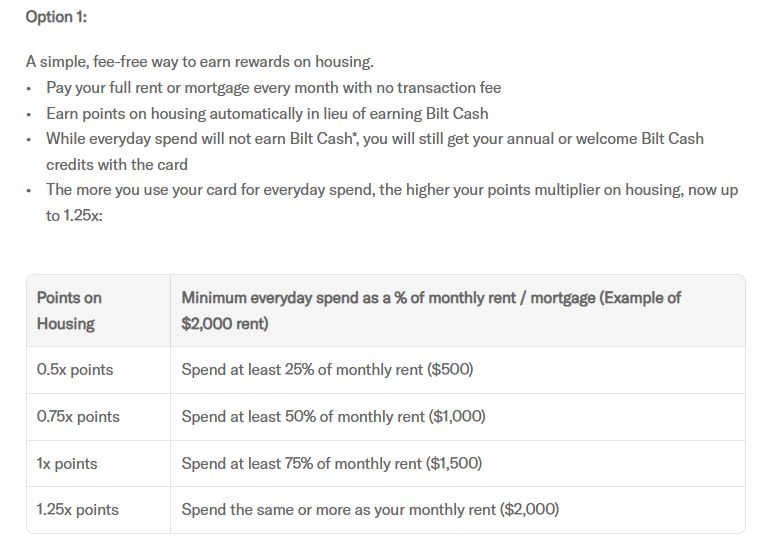

If that wasn’t clear enough, Bilt decided to throw in another option (Option 1) to earn points last Friday, one that doesn’t involve Bilt Cash at all. Now you can earn 0.5, 0.75, 1, or 1.25 Bilt points per dollar of your housing payment based on how much spend you put on your Bilt card per month, regardless of which card you choose. How you choose this option or when/how often you can change between the two is still unknown. Clear as mud? Let’s continue.

Which card is best?

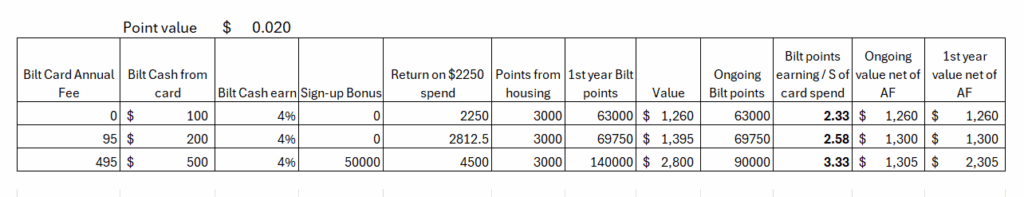

I have never been a Bilt cardholder, so I wanted to think through which earning option would be best for me, which card would be the best for me, and if I should even bother applying. Our mortgage is right at $3000 per month which should be representative of a large group of people who are curious about these questions. You can see the full data below, but here are some key observations:

- The $495 annual fee Palladium card has by far the best first-year value, $2800 if you value Bilt points at 2 cents each. This is mostly due to the 50,000 point sign-up bonus which is not available on the other 2 cards

- The ongoing value is really close and will depend mostly on:

- How you spend on the Obsidian card. I modeled only 25% of the spend on a 3X category. For me personally, it is less attractive because I can already earn 4X Amex points on both dining and grocery with the Amex Gold card

- How you value Bilt points. At 2 cpp it the Palladium is highest. Anything below that and the Obsidian is best net of the annual fees.

- How you value the other perks. The Priority Pass with the Palladium card is worthless to me unless I get rid of other cards. The hotel credit may be useful, but I don’t value it anywhere close to face value.

- If you are just focused on points per dollar value to compare to spend with other cards, the Palladium is the highest at 3.33 points per dollar. In this case I am assuming a fixed $2250 spend across each of the 3 cards, the minimum required to generate enough Bilt Cash to earn the 3000 points per month paying my mortgage. If you factor in that you don’t need to spend as much, especially in the first year, because of the Bilt Cash from the sign-up bonus then the Palladium card gets even better as you will see further below.

The key point is that by almost any measure, the Palladium card is very strong for earning on otherwise non-bonused spent. While it lacks the simplicity of the Amex Blue Business Plus (no annual fee and 2X everywhere up to $50k per year) or the CapitalOne Venture/Venture X (2X everywhere), it is certainly more rewarding. Plus, by giving you Bilt Gold status, it ensures you will be able to continue using Bilt as a 1:1 earning partner with Rakuten, which I highly value!

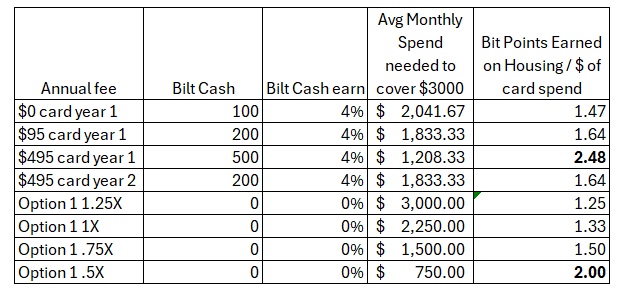

What’s better, earning Bilt Cash or “Option 1” multiples?

This is where things get interesting. Regardless of which Bilt card you choose, it will still require a decision on which path is best towards earning points for housing payments. Different than the above analysis, here I will vary the monthly spend to show the relative value of “Option 1” levels, and to factor in the different starting amounts of Bilt Cash.

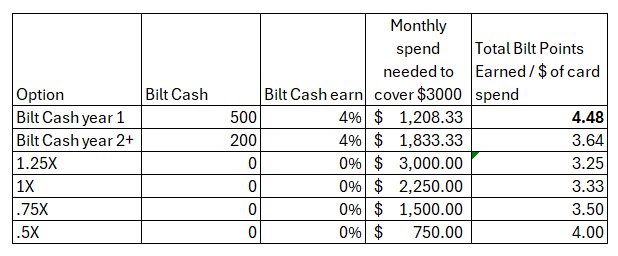

This table shows the amount of Bilt points earned per dollar of spend, ONLY on the housing portion. Not surprising, the first year of the Palladium card earning Bilt Cash is best, because the $500 starting Cash is almost half of the annual total that is required to earn the 3000 points on my mortgage each month.

What IS surprising is that for the Option 1 paths, the points per dollar earned on housing specifically gets worse as you spend more. In fact, the 1.25X earning multiplier, which is not possible on the Bilt Cash path, is significantly worse than the Bilt Cash path and is the lowest earning rate on the Option 1 path. The 2.0 points per dollar when spending exactly 25% of your housing costs is the best rate, but also considerably limits the number of total points you can earn in a year.

This also doesn’t factor in the opportunity cost of putting spend that would otherwise go to higher points earning categories with other cards, i.e. 3-4X on dining and grocery with other cards in my wallet.

Additionally, this ignores the fact that Bilt Cash can be banked month to month but not rolled over more than $100 at the end of the year. I personally don’t mind this approach and still prefer it to the Option 1 choices which will require the same spend each month. I like the idea being able to build up my Bilt Cash early in the year and then spending $0 on my card some months while still earning points paying my mortgage. This will free up spending capacity to pursue other sign-up bonuses throughout the year and not require me to check my spend throughout the month. Across the many blogs who have written about Bilt in the past week, this is the point I think is being missed the most.

Now, if we add in the 2 Bilt points per dollar earned on all purchases with the Palladium card, here is the full picture. If you spend just enough to enable points earning on housing with Bilt Cash or with the Option 1 levels, the worst you can do is 3.25 points per dollar. That is a FANTASTIC return.

If we focus just on year 1 with the seeded Bilt Cash on the card, the return skyrockets to 4.48 points per dollar. Even without the $300 sign-up bonus Bilt Cash in year 2+, the 3.64 points per dollar blows away the simple 2X earning for otherwise non-bonused spend that many sites are pushing as a better alternative.

Conclusion

I get it – simple is good and math is not fun. However, what doing the analysis showed me is that:

- The first-year value of any of the cards is very strong once you unlock earning on housing.

- For me personally, the Bilt Cash path is a much better path, both in terms of earning potential and flexibility.

- It is worth automating enough otherwise non-bonused spend (car insurance, kids monthly sports fees and music lessons, etc) that I can do much better with this path than putting that spend on our other 2X-everywhere cards.

- I will apply for the Palladium card, but I will wait a few weeks to see if any new information comes out first.

What are your thoughts on the new Bilt 2.0 program?

TL;DR: The new Bilt 2.0 launch created a lot of confusion, but if you think through it to pick an optimal path, the rewards can be very lucrative. Based on the value and flexibility, I still believe that earning Bilt Cash is the better option to maximize overall point earning, especially in the first year.