In this hobby, one of the main ways banks entice new customers to apply for a credit card is through an attractive sign-up bonus (SUB). Failing to hit the required minimum spend in the allotted time is a major mistake. But how do you know how much more spend you need to put on a card and how much more time do you have to do it? You could keep track of all of your expenses, or you could call customer service and ask them to verify, but fortunately Bank of America (BoA) has an easier option to answer both questions.

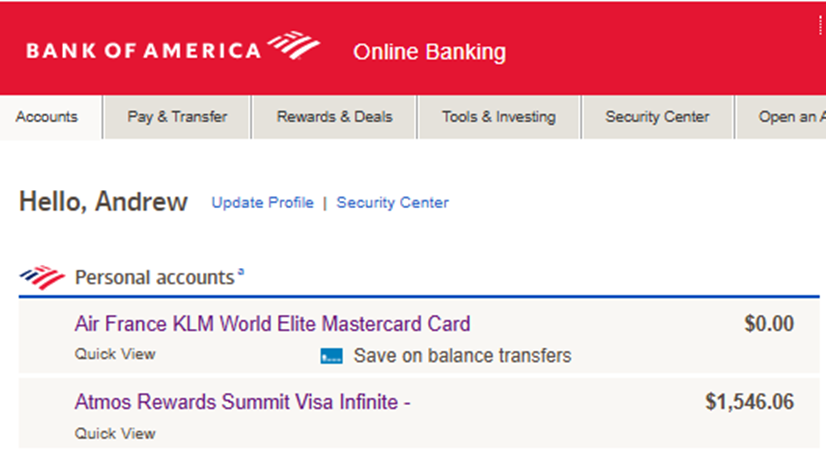

Despite their “1997-chic” website design, BoA does make it easy to track your progress. Once you log into your account you will see your card accounts on the main page. Simply click on the card you want to track to get into that account.

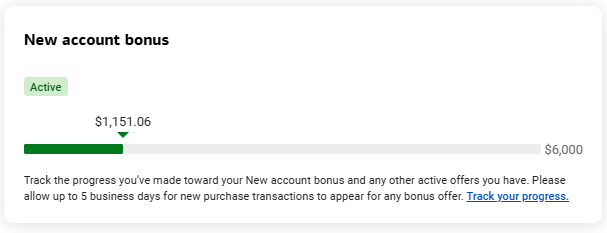

On the main account page, the Activity tab should be the default view and right at the top, above recent transactions, you will see the tracker towards your minimum spend progress. However, this view does not tell you how much time you have remaining so you will want to click the “Track your progress” hyperlink in the bottom-right of that section.

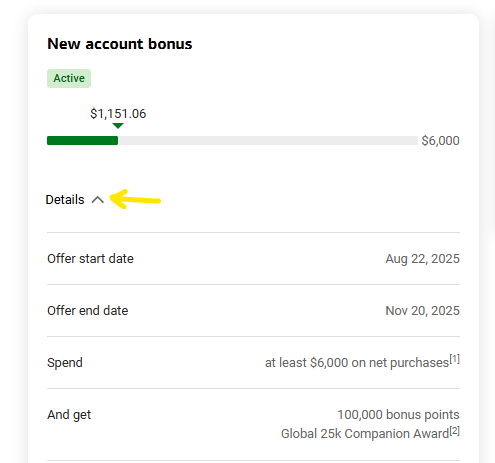

The progress page will show you both your progress to hitting the minimum spend and also separate trackers for any annual spend bonuses. If you click on Details as shown below, you will also see the time required to complete the spend.

One thing I don’t like about BoA is that the 90-day clock starts they day you are approved but it can take 7-10 days to get the card, giving you in some cases only 80 days to hit the spend requirement. Some other issuers give you over 100 days in their “3 month” calculation. Always have a plan to complete your minimum spending to earn that welcome bonus!

TL;DR: Don’t miss out on your sign-up bonus. Use the Bank of America new account bonus tracker to ensure you hit the minimum spend requirement on your new credit card in the allotted time.