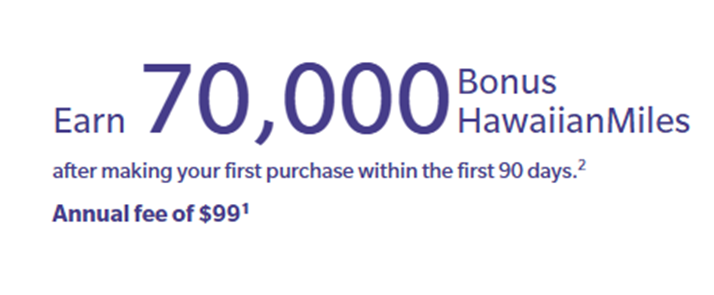

I wrote last week about our interesting experience recently applying for the Barclays Hawaiian Airlines credit card. Ultimately, me, my wife, and both of my parents were approved the card with the 70,000 mile welcome bonus after first purchase and $99 annual fee. All good, right? Not so fast!

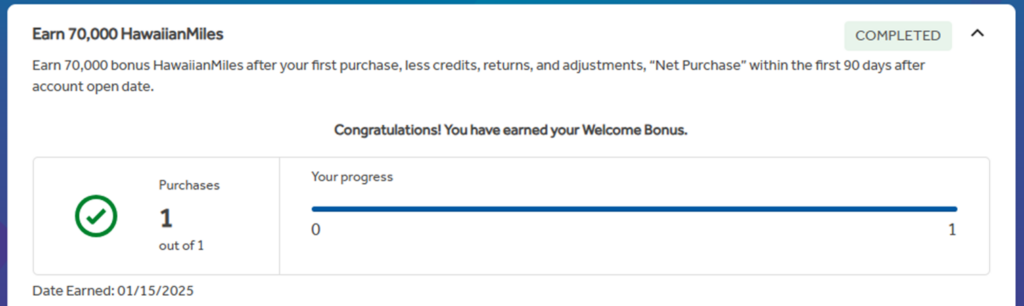

For my wife and I, everything looks normal, and our welcome bonuses posted after paying the first statement.

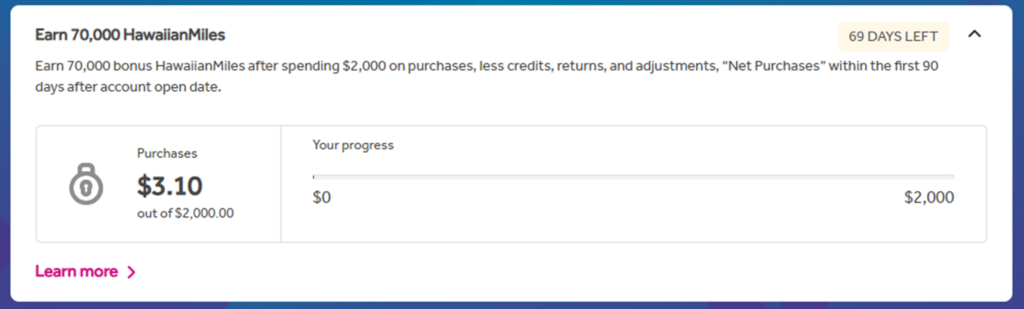

For my parents, who applied using the same link, the welcome bonus tracker is showing the current public offer of 70,000 miles after $2k minimum spend.

We thought it would be a pretty simple fix so together we called Barclays. They were adamant that there was no way to verify the offer on their end and they had to follow what was assigned by the system. They suggested calling Hawaiian which makes no sense; Hawaiian gets to sell 70k miles to Barclays either way. They also had no explanation for why the same link worked fine for my welcome bonus offer, nor would they review any materials of the offer like screenshots that we could send in to be sure the correct offer was assigned.

We escalated the call to a manager who said the same things. Eventually, my dad was offered a 10k point bonus for “the inconvenience” but to add a bit of insult to injury, they refused to offer the same to my mom despite being on the call and in the same situation because “only one account verification can be done per call”. At 45 minutes deep into it at that point, we decided to just end the call. We will probably call back and try again for her account, but I am not optimistic given the very consistent response from both the first agent and the manager. Depending how that goes, we may also file a claim with the Consumer Financial Protection Bureau. Overall, while I have been impressed with Barclays customer service in the past, this situation really felt like a bait and switch for my parents which is frustrating.

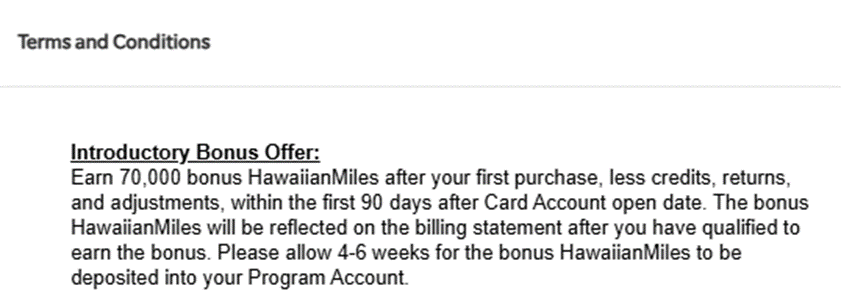

For those still interested in this card I would recommend checking out this post from Doctor of Credit that has links for a few different offers on this card and some helpful notes in the comments section. I would also highly recommend taking screenshots of the offer and terms and conditions window. Even though Barclays claims they have no way to go back and “see” what offer was applied for and can only follow what is assigned by their system, having the screenshots would be helpful if things go awry and you decide to pursue a claim through the Consumer Financial Protection Bureau.

What about you, have you ever had this type of issue with a bank not honoring their offer?

TL;DR: While not the end of the world to spend $2k to earn a welcome bonus, it is frustrating that Barclays is not honoring the offer that was made during the card applications. It is a good reminder to always take screenshots of a limited time offer during the application process.

My offer bonus is listed on my barclays account for both me and my wife under the rewards and benefits section.

Wow. Thanks for sharing.

Mine worked fine but I always take a screenshot of an offer because once the website changes, the CSR either benignly or willingly has no ‘other’ offer to see.

“ Depending how that goes, we may also file a claim with the Consumer Financial Protection Bureau.”

That’ll go nowhere fast. The current administration has made clear that financial institutions can now do whatever the hell they want with impunity.