What the heck is dynamic currency conversion (DCC)? Let’s say you are traveling abroad in Europe. Dynamic currency conversion is offered by some merchants, usually in tourist areas, that allows you to pay for your purchases in your home currency (in this case, US dollars) instead of the local currency (Euros). So, if you buy something during your trip to Europe or take cash out at an ATM, the merchant might ask if you want to pay in dollars using DCC.

Here’s the catch: while it might seem convenient to pay in dollars, it’s likely never the best option! Merchants offering DCC typically use their own exchange rates, which are much more likely to benefit them than benefit you. This means you could end up paying more for your purchase compared to if you had paid in Euros and let your bank handle the currency conversion on the back end.

I remember one of my first international business trips to England in 2009. Waiting for my return flight at London Heathrow, I was picking out a souvenir to bring home for my daughter. As I put my credit card into the card reader the store employee was extremely enthusiastic in offering me this great deal to get to pay in dollars as if it was some special promotion. Having never heard of DCC I happily accepted. It wasn’t until I saw the charge on my credit card statement the following week that I realized my mistake.

In the grand scheme of things, that experience maybe cost me $5, but what I learned from it has saved me significantly more across the dozens of international trips I have taken in the years since then.

What to do instead

During a recent trip to Austria, I decided to test this out to get a real-world example of just how much this can cost an unknowing traveler. As I strongly recommend and always do myself, while waiting for our luggage to come out at the baggage claim, I sought out an ATM. Having been burned in the past I try to never leave an airport without some cash in the local currency.

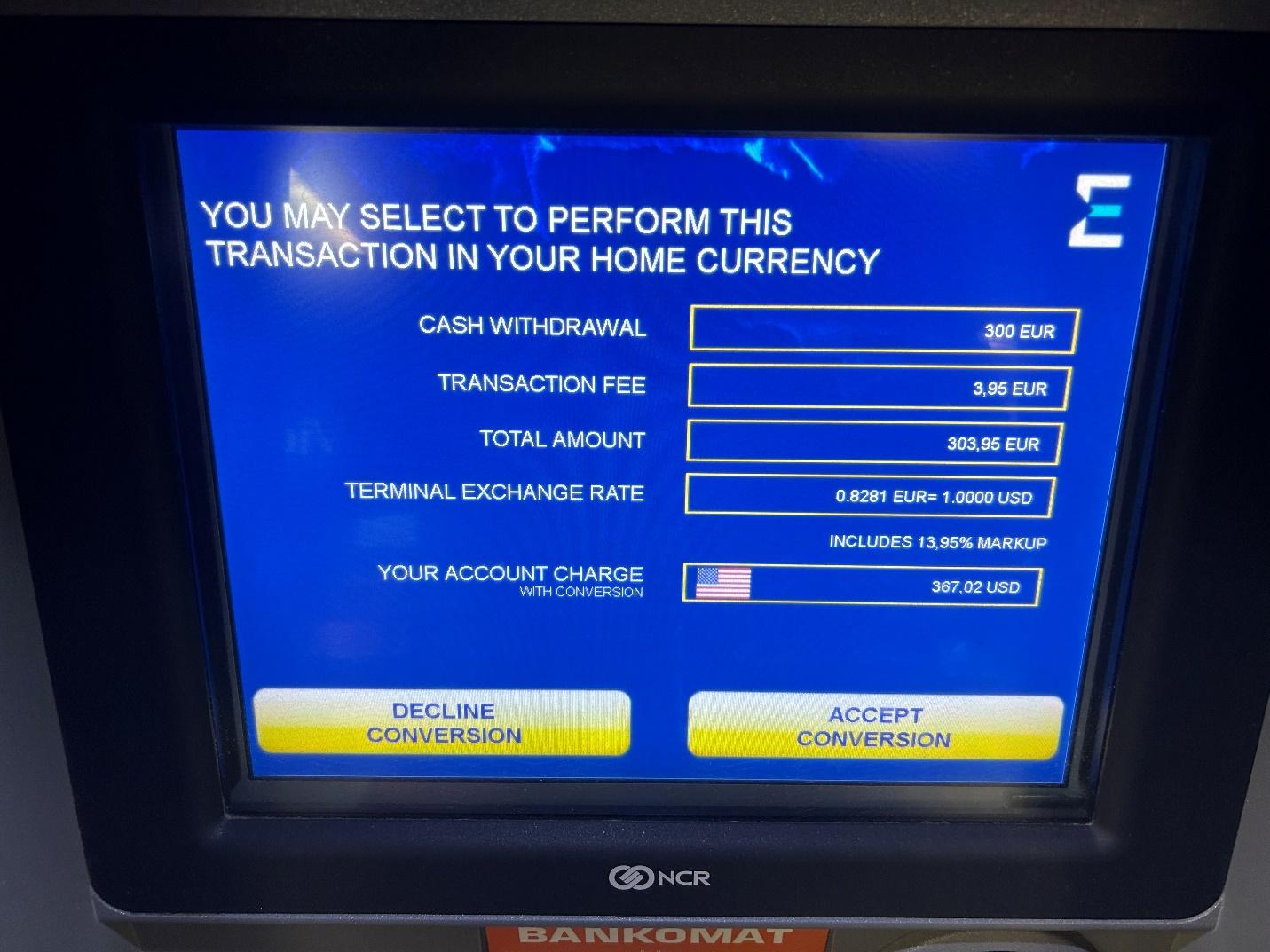

Preying on jetlagged tourists, this bank was gracious enough to offer a nominal 3.95 Euro transaction fee….and an eye-popping 13.95% markup. Even the language they use is a little predatory in my opinion. Look at the two buttons on the bottom of the photo. Since you are trying to take money from the ATM the natural inclination is to click “accept” as “decline” carries the connotation of declining the transaction. Very sneaky indeed but of course the correct choice is to “decline” the currency conversion and then complete the transaction in Euros on the next screen.

For this transaction, here was the bottom line for me: As you can see, I could have paid $367.02 to get the 300 Euro but by making the transaction in Euro and letting my home back process the conversion, it ended up costing me only $317.89 including the transaction fee reimbursement offered with my checking account. This works out to be a 1.06 dollar/Euro exchange rate (the actual rate on the day of my transaction) compared to an effective 1.22 dollar/Euro exchange rate had I taken the DCC option – a 15% premium!

What about you? Have you ever seen this trap when taking money from a foreign ATM, or been encouraged to pay in dollars when making a purchase?

TL,DR: Dynamic currency conversion (DCC) is a service that lets you pay for things in your home currency while you’re traveling abroad. However, it’s essential to be aware of the exchange rates being used, as it almost guaranteed not to be the most cost-effective way to make your purchases. Always decline the option to pay in dollars and instead just pay for that purchase in the local currency. Your bank account will thank you!

Made this mistake exactly once, a few years ago. On a recent trip to France, I was offered this option at ATMs, stores and restaurants.

I subsequently learned that an average consumer will never get a better exchange rate than the one the banks use when they convert your charge in foreign currency to dollars.

But the ATMs and stores really like “selling it”, right?!

Every time I go to Europe the accept decline buttons always throw me off. I always like to check Reddit or other travel websites as well to look for bank ATMs in the area that do not charge transaction fees. Raiffeisenbank is a good ATM in central Europe. No fees and true conversion rate. Avoid Euronet at all costs – they are everywhere.

Good advice. Well written, and it was helpful to have the real-life example, complete with picture!

Yes this is a real problem. I also learned to always “pay” in local currency when using my credit card and let Amex or Visa/MC convert for me. This latest scam (ATM “conversion”) is especially evil and misleading for the reasons you point out. Traveler beware!!