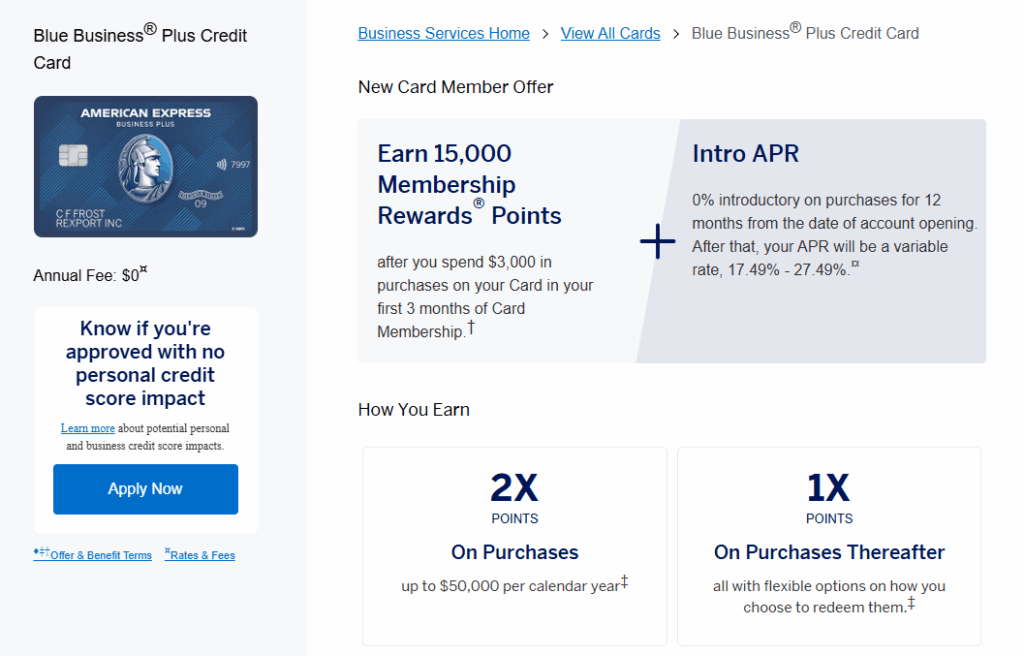

The Amex Blue Business Plus (BBP) card is a great one to get and also to keep for the long term thanks to its no annual fee, 2X points earning on all spend up to $50k per year, and importantly, the ability to transfer to the full suite of travel partners which is rare for a no annual fee card. It can serve as a great “everywhere else” card for spend outside of typical bonus categories like dining and travel. As a business card it also does not count towards your Chase 5/24 status, where you are unlikely to get approved for a new Chase card if you have 5 or more new cards with any issuer in the last 24 months.

The only downside is that the public welcome bonus is typically pretty low at 15k points. Targeted offers can be higher, but neither my wife or I have had luck getting those higher offers to show on our accounts. My wife did recently receive a higher offer from a physical mailer of 25k points but with a $6k minimum spend requirement in 4 months. Since this is a card she has wanted to add to her portfolio, is now the time to act?

How to analyze these offers

If I am comparing two potential cards that I want to keep long term, or different offers on the same card, one important metric I look at is the return per dollar of minimum spend; the higher the better. This is an easy calculation for a card like the BBP because the earn rate is 2 points per dollar with specific bonus categories. It can get a bit tougher if there are different bonus categories involved, but the calculation is still easy once you make some assumptions about where the spend will take place.

The simple calculation is the welcome bonus points plus the earning from the minimum spend requirement, divided by the minimum spend requirement. Let’s compare these two offers:

Public offer: 15k points + 6k points ($3000 x 2 points/$) / $3000 = 7 points/$ spent

Targeted offer: 25k points + 12k points ($6000 x 2 points/$) / $6000 = 6.17 points/$ spent

In this case, the public offer is actually more rewarding on a per-dollar basis even though the welcome offer is lower. Plus, with the $3000 lower spend requirement, that extra spend can go to higher points earning cards/categories, or another welcome offer. The lower spend requirement can also be attractive for someone who doesn’t have a high amount of organic spend, since you should never stretch yourself to the point you can’t pay the balance in full each month. All that said, we have one more trick to do even better!

Enter 2-player mode

The even better option here is a referral combined with the public offer bonus. Even though I do not currently have this BBP card, I can refer from any of my Amex cards to essentially any other Amex card. In this case I created the referral from my Business Gold card as it had a higher bonus (for me, as the referrer) compared to my personal Gold card, 20k points. Now the math gets even better:

Referral offer: 15k points (welcome bonus) + 20k points (referral bonus) + 6k points ($3000 x 2 points/$) / $3000 = 13.7 points/$ spent

13.7 points per dollar of spend is a fantastic return and more than double the return for our household compared to the targeted offer with the higher welcome bonus!

Interested in this card? Click here to learn more or apply (my referral link)

TL;DR: Targeted offers can often be superior to publicly available offers, but always consider the return on minimum spend and how that can be improved within a household using a referral. In this case, we were able to generate a much stronger return versus the targeted offer on the Amex Blue Business Plus.