As someone who has applied for a few dozen of credit cards in the past ten years, I’d like to think of myself as experienced in this hobby. I’ve had good luck with Barclays as well, getting auto approved for the personal Hawaiian card and American Aviator card back in December. At the time, both were offering 70k miles with just one purchase after paying the $99 annual fee. I also was approved for the Bank of Hawaii Hawaiian personal card after a quick call earlier this year when it was still possible to get both versions of the personal Hawaiian cards.

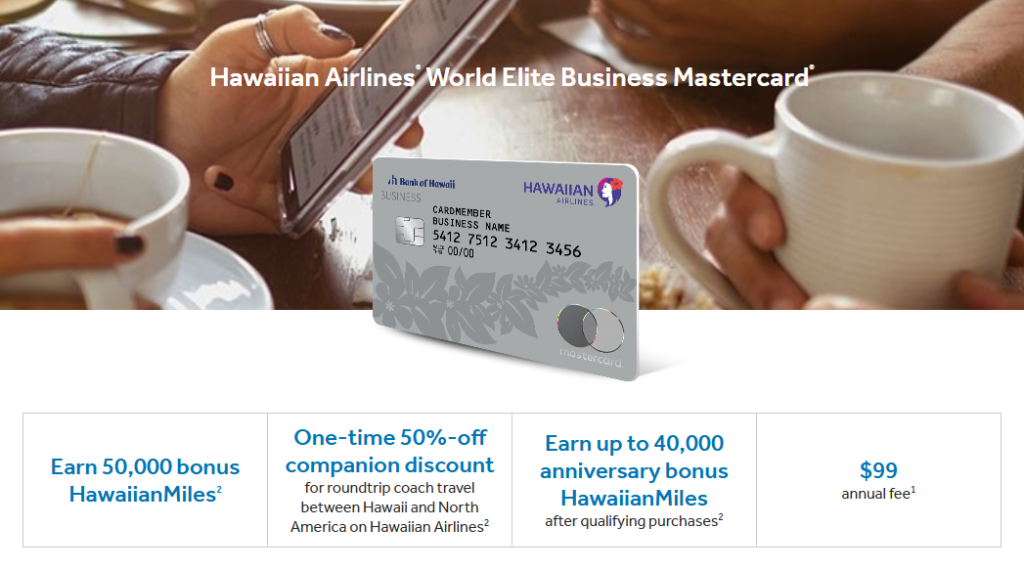

While I was thrilled to get all 3 of those cards when their sign-up bonuses were 70k miles, there was one more card I was really interested in picking up, the business version of the Hawaiian card. That card is currently offering 50k miles after $4k in minimum spend within 3 months. While not as good as the 70k offers, I was excited to apply for a few reasons:

- Since we can freely transfer Hawaiian miles to Alaska, this is like earning 13.5 Alaska miles per dollar (50k plus 4k from the min spend / $4000) which is a great return

- As a business card this should not impact my Chase 5/24 count

- With the Hawaiian-Alaska integration moving along, this card may become unavailable for new applications very soon. We know the last day to transfer Amex points to Hawaiian is 6/30, but we don’t know when the Hawaiian cards will go away

It’s tough for Barclays that they are essentially losing all 4 of these cards as soon Citi will be the sole issuer of American Airlines cards, and it is expected that all of the Hawaiian co-branded products will go away as Bank of America has exclusivity with Alaska for their co-brand cards.

My application mistake

I had been planning to apply for this card for a while, I just needed to complete my minimum spend my recent Chase Ink Unlimited card I picked up when Rakuten was offering the 30k point bonus on top of the Chase sign-up bonus. Last week I saw I was close to finishing up that minimum spend, so I decided to pull the trigger and apply for this Hawaiian business card. It initially went pending which wasn’t a surprise given that I have 3 active cards already with Barclays.

The following day, I went to check my application status at https://cards.barclaycardus.com/credit-card/cas

One nice thing with Barclays is that you can actually read a PDF of your denial letter on that site vs waiting for it to come in the mail. Once I had that open, I immediately realized my mistake. They weren’t even able to consider the application because I had my credit reports frozen….doh!

How I fixed it

I logged in to my Transunion account and set it to “thaw” my credit report for 2 days. This would allow the application to be processed and then be frozen again without any further action on my part. A few hours after thawing that report, I called Barclays reconsideration line.

As it has been with my past experience calling Barclays, the wait times were short, and the agent was friendly. I explained that the application wasn’t able to go through because I had my credit reports frozen. After confirming that my Transunion report was open, the phone agent was able to re-run the application.

After a few minutes away, he came back and asked me several questions about income and employment history. To my surprise, none of the questions were related to my business information, just personal information. Also to my surprise, he didn’t question my interest in this card despite already having the two personal Hawaiian card products.

He then asked if I would be willing to move some of my credit limit over from one of my personal card accounts in order to get this one approved. That struck me as interesting because in my experience you could only move credit limit from personal to personal or business to business accounts, but not from personal to business. In any case, I was happy to move half of my credit limit from my American Aviator card over in order to get this application approved. Two minutes later we were finished, and my new Hawaiian business card was on the way! The moral of the story is that if you keep your credit reports frozen, don’t forget to thaw those before you apply for a new credit card.

TL;DR: My application for the Barclays Hawaiian Airlines business card was instantly declined because I had my credit report frozen. After thawing the report though, they were able to re-run the application and approve it after I moved some credit limit over from a different account.