As the calendar flips to February and most New Year’s resolutions have been abandoned by now, I thought it would be good to finally lock in my miles and points related resolutions for this year.

According to Google’s AI Overview: “Publishing your New Year’s resolutions on social media or sharing them with close friends can significantly improve accountability, as the public knowledge of your goals creates a sense of pressure to follow through and can encourage others to support you in achieving them; essentially, the fear of letting people down can motivate you to stay committed to your resolutions“.

So here we go; public posting of these goals so that you can shame me hold me accountable later this year if I don’t provide updates or achieve these goals.

- Cancel or downgrade some cards I have let linger that don’t get a lot of spend

- Strategic new card applications after a few light years

- Learn more about the Bilt program

- Be more aggressive calling for retention offers and bonuses

- Try to take advantage of more transfer bonuses.

- Better plan to take advantage of perks and credits to offset annual fees

1) Cancel or downgrade some cards I have let linger in our household that don’t get a lot of spend

We have several cards in our household that have an annual fee but don’t get a lot of spend or have benefits that are covered by other cards. For example, my wife has a Chase Ink Plus card (no longer available to new applicants). While it offers the ability to transfer points to partner programs, we can already do that through my Chase Sapphire Reserve card, and she also has the no annual fee Chase Ink Cash card which matches the attractive 5X spending categories. Another card I have let linger is my Bank of America Flying Blue (KLM/Air France) card. It doesn’t get any of our normal spend but does offer an easy path to keep Flying Blue points active.

Actionable achievement: Cancel or downgrade minimum 2 cards in our household by the end of 2025

2) Strategic new card applications after a few light years

Believe it or not, for someone who writes about travel, miles & points, and credit cards, everyone in our household is currently under the Chase 5/24 limit. While we do apply for several new credit cards per year, we certainly are not as aggressive with our applications as many people in this hobby. I am currently at 3/24 and my wife is at 2/24. With some limited time opportunities in front of us such as the ability to combine Hawaiian and Alaska miles if you have the Barclays Hawaiian card, we plan to be much more aggressive in the first half of 2025.

Actionable achievement: Acquire minimum 750k points through new card sign-up bonuses including minimum 400k Alaska miles

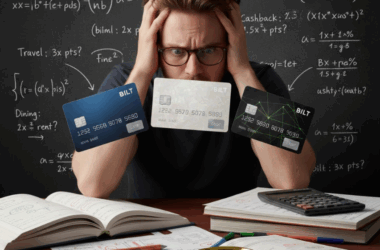

3) Learn more about the Bilt program

Since we are not renters, and have other cards with better bonus categories, the Bilt program has not been something I have pursued. However, since many of my readers may benefit from the Bilt program, and we might too later in the year if Bilt payments for mortgages becomes a reality, I want to learn more about how I can benefit from this program and its valuable transfer partners.

Actionable achievement: Sign up for the Bilt program and publish minimum 2 blog posts on my learning throughout the year

4) Be more aggressive calling for retention offers and bonuses

This one is pretty self-explanatory. I used to be more disciplined about this but over the last few years I have stopped calling my card issuers and exploring what offers may be available when my annual fees are coming due.

Actionable achievement: Make minimum 3 retention calls and publish my results

5) Try to take advantage of more transfer bonuses.

Much of the value of transferrable points is in their flexibility. Speculative transfers eliminate that flexibility so that is not something I have done in the past, even for 20-30% transfer bonuses. However, over the past few years I have booked some trips where I just missed a transfer bonus, so I want to be more proactive in considering my future travel plans when there are some attractive bonuses like the current 30% transfer bonus to Virgin Atlantic from Chase.

Actionable achievement: Book a trip that takes advantage of at least 1 transfer bonus

6) Better plan to take advantage of perks and credits to offset annual fees

With the general rise in annual fees on some popular rewards credit cards (I’m looking at you, Amex), it is important to take advantage of perks and credits offered by some cards to justify their increasingly high annual fees. This is another area I have been a bit lazy suboptimized in the past year. A few of the credits I need to take better advantage of this year include the Capital One Venture X $300 travel credit (which requires booking through their travel portal), all of my Southwest A1-15 upgraded boarding credits which I didn’t fully leverage last year from the Chase Priority and Performance business cards, the $100 annual Resy dining credit with the Amex personal Gold card and the $20 monthly flexible credit from the Amex business Gold card. If I can take advantage of these benefits and credits it will help justify paying the annual fees for these particular cards.

Actionable achievement: Take advantage of minimum $750 in credit cards perks by the end of 2025

TL;DR: There are several areas I want to improve upon for 2025 when it comes to miles and points, and by posting my goals publicly I aim to improve accountability with an actionable achievement goal for each category.