Chase is out with some elevated and compelling business card offers on the Southwest Performance Business card and the no annual fee Ink cards (Cash and Unlimited). All 3 of these cards should be subject to the Chase 5/24 rule where you are unlikely to be approved if you have 5 or more new accounts in the last 24 months. However, and importantly, these 3 cards should not ADD to your 5/24 count since they are business cards that do not show up on your personal credit report.

In my experience, even very new and small sole proprietor businesses have had pretty good luck in getting approved for these cards. Anyone with a side hustle, even with limited revenue, should consider these strong offers.

Southwest Performance card – 120k

While the 100k offers on the personal cards just expired, this new 120k point offer is in some ways even more compelling. Yes, there is a pretty steep $299 annual fee which is not waived the first year, but the 120,000 points, if timed correctly, could get you almost a full 2 years of Companion Pass in 2026-2027.

Since you currently need 135,000 points to earn the Companion Pass, and holding one of the Soutwest cards gives you a 10k point boost, that plus the minimum spend (10k assuming no bonus categories on the spend) and the 120k sign-up bonus gets you above the 135k threshold.

Since this offer is good until October 22nd, if you apply in mid-October and don’t hit your minimum spend until after your December statement closes (or in January to be extra safe), those points will post in January 2026 earning you the Companion Pass for the rest of that year and all of 2027 as well. This all assumes that Southwest makes no changes to Companion Pass earning for 2026, but if that is going to happen, it is fairly likely we will know very soon. The 120k bonus alone is worth about $1,500 in flights so that value plus the Companion Pass potential is very compelling if you plan to travel on Southwest even a few times per year.

Beyond that, the known benefits remain such as a free checked bag, free Preferred seat selection at booking, free upgrades to extra legroom seats 48 hours before departure, a $120 Global Entry/Precheck credit, 9,000 anniversary points, and group 5 boarding. Additionally, between now and the end of the year, you will keep the old benefits of 4 free A1-15 upgraded boardings, free WiFi (soon to be free to everyone) and a $500 fee credit when transferring points. I just used that $500 credit to consolidate some points scattered across a few accounts in my family, so it was useful.

Learn more here!

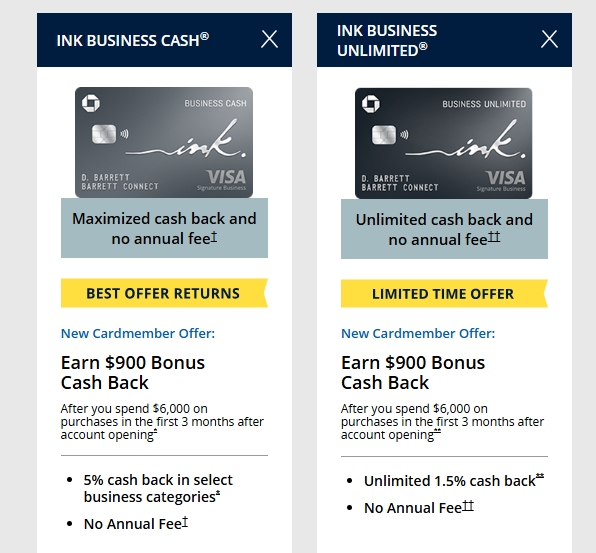

Chase Ink Cash and Ink Unlimited – 90k (or $900)

These are both great cards to get and to keep considering they have no annual fee and strong points earning. While billed as $900 cash back, if you have any Chase Ultimate Rewards earning cards such as the Chase Sapphire Preferred or Reserve or Chase Ink Preferred, you can easily combine the earning on these Ink cards with your other card to effectively turn them into 90k Chase Ultimate Rewards points.

This is important because you can potentially receive considerably more than 1 cent per point value by transferring them to travel partners. At 1.5 cents per point value, which I use as a conservative estimate, the bonus would be worth $1,350 for travel and potentially over $2,000 without much effort. One simple example would be 18 nights at a level 1 Hyatt (5k points per night, or as low as 3.5k off-peak)? That would easily cost over $2k if paying cash.

In terms of points earning, the Ink Cash is my favorite. Earning 5X points at office supply stores (which sell a wide range of products such as Amazon gift cards) and for internet, cable and phone services is the headline benefit, up to $25k in spend per year. Additionally, you can earn 2X points on gas stations and restaurant purchases. The Ink Unlimited is similar to the Freedom Unlimited personal card with a flat 1.5X earnings rate, making it good for otherwise unbonused spend. However, unlike the personal version, this card doesn’t have any 3X categories. Either way, both of these cards have strong earning for a no-annual-fee product to go along with the elevated welcome offer!

Learn more here!

What about you – will you go for any of these elevated welcome offers?

TL;DR: Chase has 3 increased offers across their portfolio of business cards. Earning 120k on the Southwest Performance card (plus a straightforward path to Companion Pass), along with 90k/$900 offers on the no-annual-fee Ink cards are all quite compelling!

I’m going for the 2 year companion pass for sure