Earlier this year I published the below list of resolutions/goals for 2025 as it relates to miles and points. Thinking through those goals was helpful in planning things like new credit card applications and my approach to some award bookings. Now that the first half of the year is in the books I wanted to check in to see where I have found success and where I need to improve for the next 6 months.

2025 Resolutions:

- Cancel or downgrade some cards I have let linger that don’t get a lot of spend

- Strategic new card applications after a few light years

- Learn more about the Bilt program

- Be more aggressive calling for retention offers and bonuses

- Try to take advantage of more transfer bonuses.

- Better plan to take advantage of perks and credits to offset annual fees

1) Cancel or downgrade some cards I have let linger in our household that don’t get a lot of spend

We have several cards in our household that have an annual fee but don’t get a lot of spend or have benefits that are covered by other cards. For example, my wife has a Chase Ink Plus card (no longer available to new applicants). While it offers the ability to transfer points to partner programs, we can already do that through my Chase Sapphire Reserve card, and she also has the no annual fee Chase Ink Cash card which matches the attractive 5X spending categories. Another card I have let linger is my Bank of America Flying Blue (KLM/Air France) card. It doesn’t get any of our normal spend but does offer an easy path to keep Flying Blue points active.

Actionable achievement: Cancel or downgrade minimum 2 cards in our household by the end of 2025

Mid-Year Check in:

I’m not starting off very strong on this list. I have not yet cancelled or downgraded any cards so far this year, but I have identified two logical candidates. I have not been using my Bank of America Flying Blue card so if I can’t get a retention offer I will very likely cancel it in the fall. Similarly, my wife’s old Chase Ink Plus (no longer available to new applicants) is not worth the annual fee since we can get similar 5X categories with the Ink Cash cards and transfer points to travel partners through her Sapphire Preferred or my Sapphire Reserve card.

2) Strategic new card applications after a few light years

Believe it or not, for someone who writes about travel, miles & points, and credit cards, everyone in our household is currently under the Chase 5/24 limit. While we do apply for several new credit cards per year, we certainly are not as aggressive with our applications as many people in this hobby. I am currently at 3/24 and my wife is at 2/24. With some limited time opportunities in front of us such as the ability to combine Hawaiian and Alaska miles if you have the Barclays Hawaiian card, we plan to be much more aggressive in the first half of 2025.

Actionable achievement: Acquire minimum 750k points through new card sign-up bonuses including minimum 400k Alaska miles

Mid-Year Check in:

While resolution 1 was a bit of a dud so far, #2 has been much better. We were very aggressive in our pursuit of Alaska miles so far this year and have already made some great redemptions, one of which I wrote about recently, or booking a return flight from Europe in American Airlines business class for 55k miles per person.

Overall, we are well on pace to surpass this goal with 580k points earned from welcome bonuses so far and another 200k coming soon after we hit minimum spend. That breaks down to 490k Alaska miles (earned as Hawaiian miles, combined and sent to my Alaska account), 75k Chase points, and 215k American miles.

3) Learn more about the Bilt program

Since we are not renters, and have other cards with better bonus categories, the Bilt program has not been something I have pursued. However, since many of my readers may benefit from the Bilt program, and we might too later in the year if Bilt payments for mortgages becomes a reality, I want to learn more about how I can benefit from this program and its valuable transfer partners.

Actionable achievement: Sign up for the Bilt program and publish minimum 2 blog posts on my learning throughout the year

Mid-Year Check in:

I was really hoping Bilt would come out with their new plan on supporting mortgage payments with points earning, but unfortunately that has not happened yet which has kept my interest in Bilt on the back burner. Hopefully, that capability comes out soon so I can increase my points earning but also gives me something to write about and hit this goal.

4) Be more aggressive calling for retention offers and bonuses

This one is pretty self-explanatory. I used to be more disciplined about this but over the last few years I have stopped calling my card issuers and exploring what offers may be available when my annual fees are coming due.

Actionable achievement: Make minimum 3 retention calls and publish my results

Mid-Year Check in:

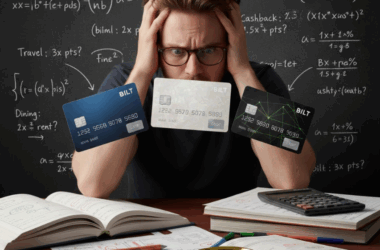

I am not quite on pace but did have a recent positive experience. Both my wife and I currently have the Amex Business Gold card and my annual fee hit in June. Since I have other Amex Membership Rewards earning cards that can transfer to travel partners, this one has not been as useful lately, especially since we don’t often take advantage of the 4X points on gas having 2 EVs in our household.

After my annual fee hit, I did chat with Amex to explore my options. Ultimately, I did decide to keep the card and was happy to receive a 35k point retention bonus after $5k spend over the next 3 months. That works out to 7 Amex points per dollar before any category bonuses which is a pretty robust return on that spend.

5) Try to take advantage of more transfer bonuses.

Much of the value of transferrable points is in their flexibility. Speculative transfers eliminate that flexibility so that is not something I have done in the past, even for 20-30% transfer bonuses. However, over the past few years I have booked some trips where I just missed a transfer bonus, so I want to be more proactive in considering my future travel plans when there are some attractive bonuses like the current 30% transfer bonus to Virgin Atlantic from Chase.

Actionable achievement: Book a trip that takes advantage of at least 1 transfer bonus

Mid-Year Check in:

I am happy to report that I did book one big trip using the still-available transfer bonus from Chase to Air Canada for our spring break trip to Italy next year. Without the bonus, 4 seats in business class for our flights to Europe would have cost 280k points, but with the transfer bonus we only spent 234k for a savings of 46k Chase points!

6) Better plan to take advantage of perks and credits to offset annual fees

With the general rise in annual fees on some popular rewards credit cards (I’m looking at you, Amex), it is important to take advantage of perks and credits offered by some cards to justify their increasingly high annual fees. This is another area I have been a bit lazy suboptimized in the past year. A few of the credits I need to take better advantage of this year include the Capital One Venture X $300 travel credit (which requires booking through their travel portal), all of my Southwest A1-15 upgraded boarding credits which I didn’t fully leverage last year from the Chase Priority and Performance business cards, the $100 annual Resy dining credit with the Amex personal Gold card and the $20 monthly flexible credit from the Amex business Gold card. If I can take advantage of these benefits and credits it will help justify paying the annual fees for these particular cards.

Actionable achievement: Take advantage of minimum $750 in credit cards perks by the end of 2025

Mid-Year Check in:

For this category I am not going to count things like hotel free nights which I have always been good about using or credits that don’t require any extra work, such as the Chase Sapphire Reserve $300 travel credit that is automatically applied to any travel expenses. And to make it a little tougher, I am not even going to count the CapitalOne Venture X $300 travel credit which I did use this year but requires booking through their travel portal.

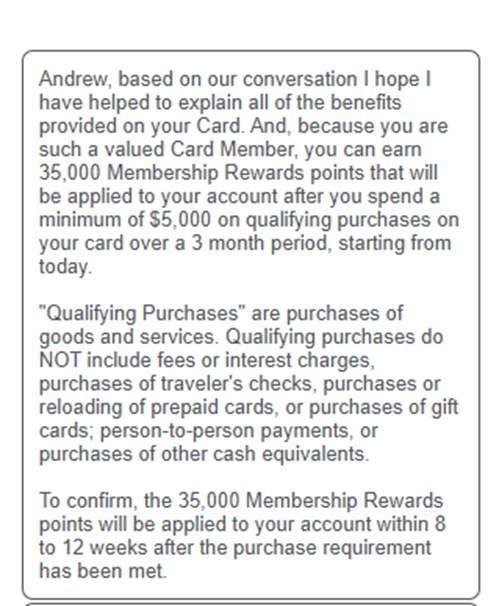

Overall, I am happy with my progress here both in terms of the number of credits I have been able to use but also finding some easier ways to redeem them going forward through trial and error. Year to date I am around $460 broken down this way by card:

Amex personal Gold card: $50 Resy dining credit, $70 ($10/month) Uber credit, $10 restaurant credit, ~ $20 Dunkin credit ($7/month). I did learn that you can load a custom amount ($7) into the Dunkin app which does trigger the credit, so now I will do that each month to build a bigger balance there

Amex Business Gold card: We did start using the Walmart Plus monthly credit and parlayed that into free Paramount Plus as well (~$50 year to date) but I was late to testing out the monthly $20 flexible business credit. I did test it last month with a $25 e-gift card from Staples.com which fortunately does trigger the credit. That makes the credit much easier to use going forward and I plan to use it the rest of the year.

Southwest Business Performance card: My Global Entry was due so I used the $120 credit from this card to pay for it. I have also used ~ 10 in-flight WiFi credits ($80) and one A1-15 boarding upgrade ($40) so far this year.

TL;DR: After setting 6 miles and points goals as a New Year’s Resolution at the beginning of the year, I wanted to check in and measure my progress. While a few are still lagging, overall I am on track to hit these goals and particularly happy with my points earning, usage of a transfer bonus and success using various credits available on some of my cards.