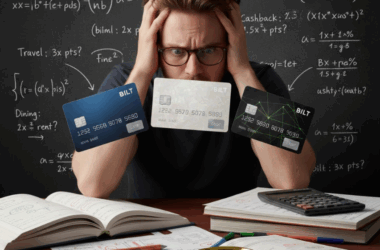

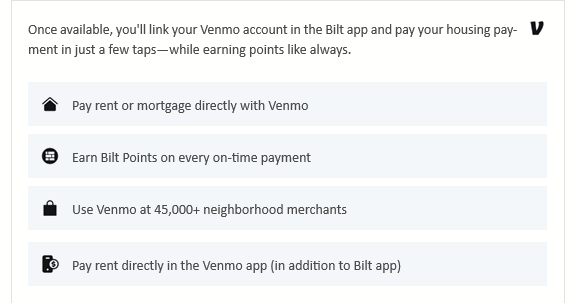

Bilt and Venmo were out with exciting news this week, announcing their partnership that will enable rent and (importantly) mortgage payments in early 2026. This is great news for a broader group of Bilt members as their previous announcement on earning points while paying mortgages was exclusive to United Wholesale Mortgage (UWM) customers. While the announcement doesn’t specifically call out “all mortgages” as being eligible, it would seem strange to make such an announcement and not expand beyond the UWM partnership.

Of lesser news, but still interesting is that this partnership will also allow Venmo as a payment method across Bilt’s network of over 45,000 neighborhood merchants. More options are always better, although I see this being most useful on dining partners. I doubt anyone will want to split payment with friends on a Walgreens purchase, lol.

Earning potential

The big assumption here is that there will be no fee to pay your mortgage this way, similar to how rent can be paid today. We also don’t know the earning structure yet, but this could be a very lucrative option given Bilt’s very strong lineup of transferrable points partners such as Atmos Rewards and World of Hyatt. Earning 1 point per dollar and a $3k per month mortgage would be enough for 8 short one-way flights on American (through Alaska Atmos at 4.5k points one way) or ~7 nights in a category 1 Hyatt property (5k per night standard pricing). Both of those options could easily be worth $1000 of travel.

Open questions

While I am really excited about this news, there remains some open questions:

- Will mortgage payments be free of processing fees like rent payments are set up today? I am guessing yes.

- Is there a cap on the annual earnings? I expect there will be a cap such as $100k in payments.

- Will you earn 1 Bilt point per dollar? I assume yes, it will be 1 point per dollar.

- Will all mortgage companies be eligible? I really hope this is the case! We should learn more in the next few months

- Could this approach stack with Mesa rewards and effectively double-dip Mesa and Bilt points on mortgage payments? I think this will be the case since Mesa is not involved in processing the payments and separately requires $1k spend on the card each month to activate the points earning on mortgage spend. This potential is very exciting!

TL;DR: Bilt and Venmo are partnering and in early 2026 will expand payment processing to mortgages. This is a very exciting opportunity to earn highly valuable transferrable points on what is most people’s largest monthly expense!